Automating Regulatory Reporting

for Future-Ready Organizations

Our AI-powered compliance suite enables top banks and other FIs to simplify filings, ensure accurate reports, mitigate risk, and build audit-ready trust with regulators

Who Are We

Asia's leading regulatory reporting provider, ISO 9001:2015 & ISO 27001:2022 certified, committed to helping global organizations automate compliance through innovative reporting solutions.

Our Solution

Automated regulatory reporting platform engineered to transform raw, siloed data into precise, submission-ready reports for regulators.

For Banks

Automatically aggregate data from various banking systems and ensure real-time accuracy for reporting, dramatically reducing the cost and time of compliance examinations.

For Asset Management Companies

Seamlessly integration of portfolio data to automate exposure and performance reporting required by modern investors and regulators and provide a single source of truth for transparent client and regulatory communication.

For Insurances

Streamline complex financial condition reports and enhance risk management by providing a clear, auditable view of your financial standing.

For Capital Markets

Automate trade and transaction reporting across global jurisdictions and achieve real-time validation to prevent rejected reports and associated fines.

For Crypto Exchanges

Manage high-stake regulatory burdens in finance for crypto exchanges and reduce the cost of error saving from massive financial penalties, reputational damage, and loss of licensing.

How is Finguine Different

Customers choose our platform for its unmatched ROI, rapid deployment and advanced automation. Most new business comes from client referrals - our strongest driver of growth

What We Do

A unified reporting data pipeline infrastructure that consolidates and automates your entire regulatory output.

FATCA & CRS

Eliminate the risk of penalties for non-compliance with international tax agreements.

- •Automated Compliance: We seamlessly collect, validate, and format client data against the latest IRS and OECD rules.

- •End-to-End Handling: From account classification and due diligence tracking to generating ready-to-submit XML files for multiple jurisdictions.

Standardized SDMX & XBRL

- •ECB & IMF Reporting: Our product is built on the SDMX standard, making complex statistical reports (e.g., ECB BSI, IMF data) efficient and consistent. Our platform understands the data structures and validation rules inherently.

- •XBRL Reporting: For regulators mandating XBRL, we automate the tagging and creation of instance documents, ensuring technical accuracy and freeing your team to focus on the analysis, not the formatting.

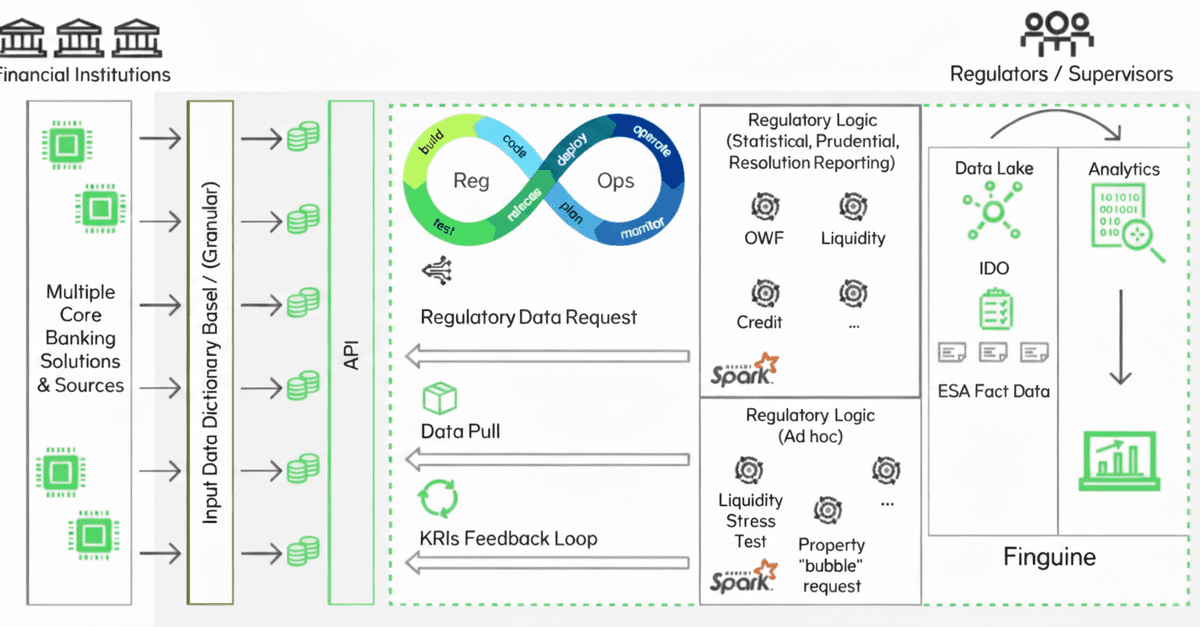

Reporting Data Pipeline

This is our core engine. We don't just generate reports; we transform your IT infrastructure to a robust, reliable and auditable pipeline.

- •Data Aggregation: Connects to your core banking, trading, and CRM systems.

- •Data Validation & Enrichment: Applies business and regulatory rules to ensure data integrity before it enters the reporting workflow.

- •Transformation & Mapping: Automatically transforms raw data into the required standards (SDMX, XBRL, XML).

- •Audit Trail: A complete, immutable record of every data point's journey for full traceability.

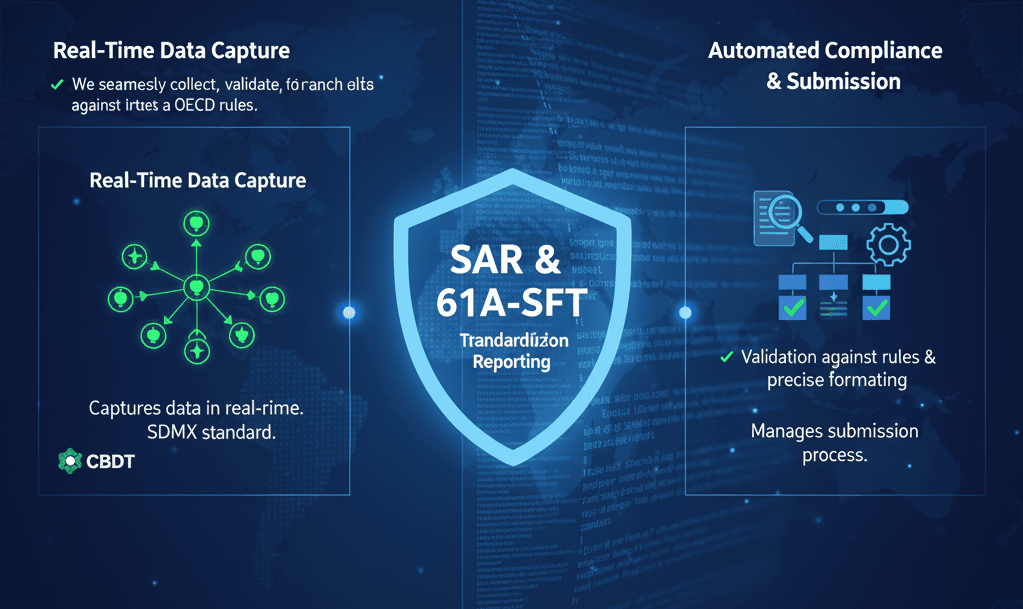

Suspicious Activity Reporting

- •For authorities like the CBDT requiring detailed SFT reports, our platform captures transaction-lifecycle data in real-time.

- •We validate it against reporting rules, format it precisely, and manage the submission process, ensuring transparency and reducing the operational burden on your compliance team.

Your Guide to Regulatory Reporting

All you need to know about our solutions. Get the complete brochure in one click.

Our Approach

A unified reporting data pipeline infrastructure that consolidates and automates your entire regulatory output.

1

Data Pipeline: The Foundational Backbone

The data pipeline is the core infrastructure that manages the flow of information from source systems to regulatory submission ensuring data integrity, completeness, and traceability.

2

Standardization: Ensuring Consistency and Compliance

Involves applying consistent rules and formats across the entire reporting lifecycle to ensure uniformity and adherence to regulatory schemas.

3

Automation: Driving Efficiency and Reducing Risk

Executes standardized processes within the data pipeline with minimal manual intervention, maximizing efficiency and minimizing human error.

4

Configuration: The Key to Agility and Adaptability

A configuration-based approach ensures the platform remains agile and adaptable to regulatory changes without requiring costly and time-consuming code modifications.

5

Control Framework Design and Implementation

Professional oversight ensures alignment with regulatory intent and business strategy, flags complex cases, and applies expert judgment for nuanced decisions.

“ Services provided by Finguine (A VSM Software Product) team for FATCA/CRS filing is satisfactory and very helpful. The team’s outstanding technical Knowledge, very good functional knowledge, quick TAT and timely output ensured we finished the filing on time and in a satisfactory manner. ”

Chief Manager - Leading Public Sector Bank based out of Chennai

Regular

No Past Data

Comparison not possible or not normally done.

Manual Scrutiny

Susceptible to errors, commissions and omissions.

Manual Upload

As organizations or financial institutions grow, they face more data sources, higher data volumes, and increased interactions. This makes transitioning to automated reporting crucial, as relying on manual systems becomes unsustainable and riskier with size.

Remediation

Initiating communication with account holder: This is a very tedious process under manual system – identify the customer id, draft the mail, list out incorrect data and send the mail – again errors cannot be ruled out while carrying out this activity.

Data Purification

Rarely thought of or implemented in a manual environment.

Finguine

Rich Historical Data

Reported data of the previous year is always compared and exception report generated by the application.

Low Touch

All errors relating to manual scrutiny are eliminated.

Automate Process

Reduces the levels of manual intervention and data adjustment, automation ensures that institutions are better able to meet their compliance reporting requirements such as timeliness, accuracy and quality.

Remediation

Initiating communication with account holder has been automated; the application picks up the email-id, customer id from the report/database, lists out the error points and sends the communication automatically. This is very fast and error-free and no manual involvement is required.

Data Purification

Data which are apparently invalid are listed out in the form of exception reports. Cleansing is taken up by the RFI so that the reports submitted are correct.

FAQ's

Experience Today with Finguine

Start with the one-stop solution for TAX compliance and explore our products